Current Oil Price

Moderator: Peak Moderation

-

Little John

- emordnilap

- Posts: 14815

- Joined: 05 Sep 2007, 16:36

- Location: here

Yes. It also highlights the stupidity (we've all done it) of relying on a finite resource for long-term happiness.

And especially those among the very filthiest and most criminally damaging of these resources, ones that a more mature version of us would leave in the ground, for instance:

And especially those among the very filthiest and most criminally damaging of these resources, ones that a more mature version of us would leave in the ground, for instance:

SourceFor countries like Venezuela or Iran, the sharp drop oil prices means they will not be able to sustain their government-run social programs.

I experience pleasure and pains, and pursue goals in service of them, so I cannot reasonably deny the right of other sentient agents to do the same - Steven Pinker

The price of oil is being actively driven down at present not least by institutions like the CME Group which is an oil trading house, changing their trading rules to suppress the price.

The effect of this is to drive speculators out and drastically cut the number of buyers in the market.

in English this means that all trades in oil futures require the buyer to have 100% of the purchase price in hard assets that can be used to pay for the oil. Normally, they are only required to hold 15% because a loss of more than 15% is not expected before they offload the contract onto someone else.IMPORTANT NOTICE – Effective 4pmCentral Time, after the close of the US markets on November 26th, we will be margining all clients at 100% of exchange required margins for Crude Oil, RBOB, and Heating Oil related trading. This is in response to the impending OPEC meeting, with results to be released at 9am CT tomorrow November 27th.

The effect of this is to drive speculators out and drastically cut the number of buyers in the market.

- emordnilap

- Posts: 14815

- Joined: 05 Sep 2007, 16:36

- Location: here

- biffvernon

- Posts: 18538

- Joined: 24 Nov 2005, 11:09

- Location: Lincolnshire

- Contact:

http://www.reuters.com/article/2014/11/ ... GK20141128Saudi Arabia's oil minister told fellow OPEC members they must combat the U.S. shale oil boom, arguing against cutting crude output in order to depress prices and undermine the profitability of North American producers.

Ali al-Naimi won the argument at Thursday's meeting, against the wishes of ministers from OPEC's poorer members such as Venezuela, Iran and Algeria which had wanted to cut production to reverse a rapid fall in oil prices.

They were not prepared to offer big cuts themselves, and, choosing not to clash with the Saudis and their rich Gulf allies, ultimately yielded to Naimi's pressure.

"Naimi spoke about market share rivalry with the United States. And those who wanted a cut understood that there was no option to achieve it because the Saudis want a market share battle," said a source who was briefed by a non-Gulf OPEC minister after Thursday's meeting.

- adam2

- Site Admin

- Posts: 10895

- Joined: 02 Jul 2007, 17:49

- Location: North Somerset, twinned with Atlantis

I am shocked, any sensible person can see and understand reasons for a decline in oil prices, but I am shocked by the scale of the decline.

I did not expect to see Brent crude much below $100 for a sustained period.

I did not expect to see Brent crude much below $100 for a sustained period.

"Installers and owners of emergency diesels must assume that they will have to run for a week or more"

-

3rdRock

- frank_begbie

- Posts: 817

- Joined: 18 Aug 2010, 12:01

- Location: Cheshire

Lots of countries struggling with the low oil price, makes you wonder how they survived when it was only $20 a barrel?

Not that long ago.

http://www.macrotrends.net/1369/crude-o ... tory-chart

Not that long ago.

http://www.macrotrends.net/1369/crude-o ... tory-chart

"In the beginning of a change, the patriot is a scarce man, brave, hated, and scorned. When his cause succeeds however, the timid join him, for then it costs nothing to be a patriot."

- biffvernon

- Posts: 18538

- Joined: 24 Nov 2005, 11:09

- Location: Lincolnshire

- Contact:

- biffvernon

- Posts: 18538

- Joined: 24 Nov 2005, 11:09

- Location: Lincolnshire

- Contact:

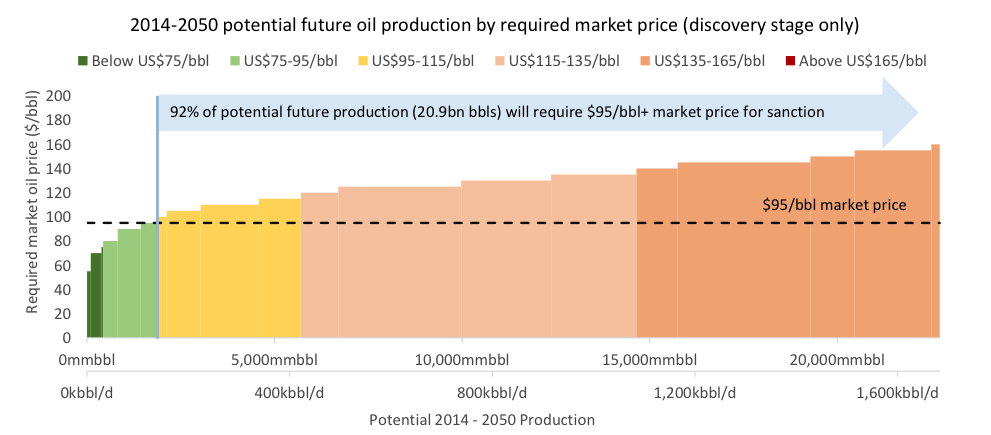

Here's a nice diagram in the context of sub $70 oil:

Carbon Tracker on the money: http://www.carbontracker.org/report/oilsands/

Carbon Tracker on the money: http://www.carbontracker.org/report/oilsands/

-

3rdRock

1st December: Brent crude hit $67.53 a barrel, the lowest it has been since October 2009, before regaining some ground.

http://www.bbc.co.uk/news/business-30276353

http://www.bbc.co.uk/news/business-30276353

The rouble suffered its biggest one-day decline since 1998 as oil prices continued to fall on Monday, escalating fears about the Russian economy.

- emordnilap

- Posts: 14815

- Joined: 05 Sep 2007, 16:36

- Location: here

Apparently, the end is nigh.

The Gulf states “don’t have a price target, and if prices drop further below $60, it won’t be for long,” the Wall Street Journal quotes people familiar with the situation.

I experience pleasure and pains, and pursue goals in service of them, so I cannot reasonably deny the right of other sentient agents to do the same - Steven Pinker

Brent below $67. WTI $64

Shale is losing money hand over fist, but the oil business has huge momentum, even for the smaller players. A lot of future oil purchases are hedged - ie the price is guaranteed months or years ahead. When the cash price crashes, it is the buyers that lose out. When the price spikes, the oil companies lose.

Drilling is and will continue to slow down. At what point this leads to production falls, and when this is visible above the noise of seasonal variation, is less clear.

We could reach a position where the US becomes global marginal consumer. Shale production continues even when it is losing money, this sucks money out of the US consumer economy, driving down US demand rapidly, and combined with weak demand in Europe, Japan and China, drives the oil price even lower. The US may enter a deflationary spiral, with the country awash with oil it cannot sell, and the streets littered with cars that no-one can afford to drive. Might be a sweet irony.

North Sea production has declined 63% from peak. The 2 year hiatus in decline is almost certainly over, job layoffs already announced. Old, marginal wells will start to be shut down permanently.

Shale is losing money hand over fist, but the oil business has huge momentum, even for the smaller players. A lot of future oil purchases are hedged - ie the price is guaranteed months or years ahead. When the cash price crashes, it is the buyers that lose out. When the price spikes, the oil companies lose.

Drilling is and will continue to slow down. At what point this leads to production falls, and when this is visible above the noise of seasonal variation, is less clear.

We could reach a position where the US becomes global marginal consumer. Shale production continues even when it is losing money, this sucks money out of the US consumer economy, driving down US demand rapidly, and combined with weak demand in Europe, Japan and China, drives the oil price even lower. The US may enter a deflationary spiral, with the country awash with oil it cannot sell, and the streets littered with cars that no-one can afford to drive. Might be a sweet irony.

North Sea production has declined 63% from peak. The 2 year hiatus in decline is almost certainly over, job layoffs already announced. Old, marginal wells will start to be shut down permanently.