Current Oil Price

Moderator: Peak Moderation

Lifting the US crude oil export ban would be a complete irrelevance on the global market. It would raise the price of WTI linked grades in the mid-west closer to the Brent price, but only a few million barrels of oil is traded at those prices, and it would simply move profits from US refineries to US drilling companies. It would allow the fracking bubble to stay inflated for a few months longer before the disastrous decline rates overwhelm their cash flows. However, it will only marginally increase peak production, and make the shark fin decline even steeper.

A little light sweet crude would be exported to European refineries, but this is fine-tuning in the balance of different grades - the US will still be importing 40%+ of its oil, all at Brent prices.

Trouble with Libyan tribal control of their major fields is a far bigger news story.

A little light sweet crude would be exported to European refineries, but this is fine-tuning in the balance of different grades - the US will still be importing 40%+ of its oil, all at Brent prices.

Trouble with Libyan tribal control of their major fields is a far bigger news story.

-

kenneal - lagger

- Site Admin

- Posts: 14290

- Joined: 20 Sep 2006, 02:35

- Location: Newbury, Berkshire

- Contact:

They haven't taken into account the 8 or 9 billion gallons of oil necessary to produce the ethanol.vtsnowedin wrote:From the article.kenneal - lagger wrote:They got the timing of this article a bit wrong!Anybody else see anything wrong in their math?FACT: The 13.3 billion gallons of ethanol in 2012 displaced the need for 465 million barrels of oil, at a savings of $47.2 billion to the U.S. economy. This is roughly the equivalent of 12% of total U.S. crude oil imports.

Action is the antidote to despair - Joan Baez

- RenewableCandy

- Posts: 12777

- Joined: 12 Sep 2007, 12:13

- Location: York

Those rates, if true at the time, are nearly all going down in real life. I don't think population (as such) is going to "expand to fill the slack": the demographic transition is for real.vtsnowedin wrote:Probably not but the real rate of growth is trouble enough.biffvernon wrote:There's no conceivable way that population could double in 20 years.

http://sweeneyr.faculty.mjc.edu/Populat ... Nation.pdf

But to be fair, consumption-per-person, might if nothing else happens to slow it.

-

vtsnowedin

- Posts: 6595

- Joined: 07 Jan 2011, 22:14

- Location: New England ,Chelsea Vermont

Yes ! There is that plus the simple conversion of barrels to gallons is wrong and it takes more then a gallon of ethanol to replace a gallon of crude. Using the gasoline to ethanol equivalent of (1.53 to 1 )13.3 billion gallons of ethanol replaced just 207 million barrels and used more crude to produce then it replaced.kenneal - lagger wrote:They haven't taken into account the 8 or 9 billion gallons of oil necessary to produce the ethanol.vtsnowedin wrote:From the article.kenneal - lagger wrote:They got the timing of this article a bit wrong!Anybody else see anything wrong in their math?FACT: The 13.3 billion gallons of ethanol in 2012 displaced the need for 465 million barrels of oil, at a savings of $47.2 billion to the U.S. economy. This is roughly the equivalent of 12% of total U.S. crude oil imports.

-

vtsnowedin

- Posts: 6595

- Joined: 07 Jan 2011, 22:14

- Location: New England ,Chelsea Vermont

Well that list is a bit dated but if you compare it's projections to current data it was pretty good in it's results to date. The trouble comes from those countries with a short doubling time and an already high population vs. the resources of the country. Egypt being perhaps the best example. If you are already out of food ,water, and energy what do you feed the increase with. Here is a projection of the top 20 countries for 2050 from more current UN data. Of that list I see nine of the twenty as disasters in the making.RenewableCandy wrote:Those rates, if true at the time, are nearly all going down in real life. I don't think population (as such) is going to "expand to fill the slack": the demographic transition is for real.vtsnowedin wrote:Probably not but the real rate of growth is trouble enough.biffvernon wrote:There's no conceivable way that population could double in 20 years.

http://sweeneyr.faculty.mjc.edu/Populat ... Nation.pdf

But to be fair, consumption-per-person, might if nothing else happens to slow it.

http://geography.about.com/od/lists/a/2050pop.htm

-

kenneal - lagger

- Site Admin

- Posts: 14290

- Joined: 20 Sep 2006, 02:35

- Location: Newbury, Berkshire

- Contact:

I can't see the African countries increasing that much. If they don't fight each other they will be conducting tribal wars over resources. Just look at south Sudan: hasn't been in existence more than a year and one tribe is trying to pinch all the oil from the other!!

Action is the antidote to despair - Joan Baez

-

vtsnowedin

- Posts: 6595

- Joined: 07 Jan 2011, 22:14

- Location: New England ,Chelsea Vermont

Agreed , those are rosy eyed projections that ignore the realities of the situation. I expect resource wars to bring the African countries population growth to an end and even the beginning of world population reduction to begin there. The question is how best to avoid getting sucked into these conflicts considering our demand for the oil they still have available for export.kenneal - lagger wrote:I can't see the African countries increasing that much. If they don't fight each other they will be conducting tribal wars over resources. Just look at south Sudan: hasn't been in existence more than a year and one tribe is trying to pinch all the oil from the other!!

-

vtsnowedin

- Posts: 6595

- Joined: 07 Jan 2011, 22:14

- Location: New England ,Chelsea Vermont

Global shortage of distillate fraction, ie. diesel, heating oil and jet fuel.

US Shale oil is very light oil, great for petrol, very poor for distillate.

US demand for heating oil is very high at the moment, thanks to Global Warming (TM) .

I have long known that diesel et al would run short before other fractions. Low hanging fruit and all that.

(Didn't stop me buying diesel car and house primarily heated with oil )

)

Libya is beginning to fall apart again, Iraq is looking very shaky, Syria continues to be a disaster, South Sudan is not a happy place, Pakistan had a major pipeline cut by terrorists yesterday, etc., etc.

Oh and Egypt is on course to be a net NG importer from next year, as well as a net oil importer.

US Shale oil is very light oil, great for petrol, very poor for distillate.

US demand for heating oil is very high at the moment, thanks to Global Warming (TM) .

I have long known that diesel et al would run short before other fractions. Low hanging fruit and all that.

(Didn't stop me buying diesel car and house primarily heated with oil

Libya is beginning to fall apart again, Iraq is looking very shaky, Syria continues to be a disaster, South Sudan is not a happy place, Pakistan had a major pipeline cut by terrorists yesterday, etc., etc.

Oh and Egypt is on course to be a net NG importer from next year, as well as a net oil importer.

- emordnilap

- Posts: 14815

- Joined: 05 Sep 2007, 16:36

- Location: here

Interestingly, Tverberg sees downward pressure on oil prices.vtsnowedin wrote:From where? It is still $6.60 above its low for the year.emordnilap wrote:Price still going down.

.

It looks like a manipulated high price held between $90 and $100 to me. You have to keep that tar sands oil profitable after all even after its quality discounts .

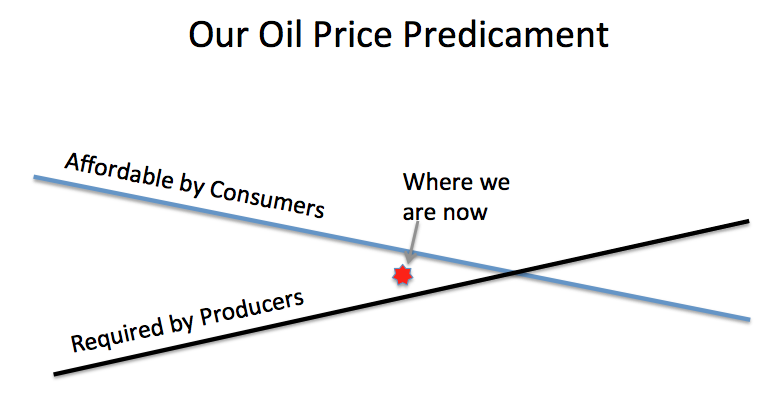

Even though the cost of extracting oil is increasing, the feedback loops that occur when oil prices actually do rise are such that oil prices tend to quickly fall back, if they actually do rise.

Source.We saw [...] that global oil prices seem already to be trending downward

One may complain of high fuel prices but this is a relative view conditioned by the few decades we've been alive. Things are very different now; we've lived through a blip of 'good' times. There are new normals now.

I experience pleasure and pains, and pursue goals in service of them, so I cannot reasonably deny the right of other sentient agents to do the same - Steven Pinker

-

vtsnowedin

- Posts: 6595

- Joined: 07 Jan 2011, 22:14

- Location: New England ,Chelsea Vermont

A bit long winded and disorganized and I think totally wrong. It makes points using data from the upside of the curve and assumes that the results will carry to the down side. A very dubious assumption. True high prices will reduce demand and reduce wages but when considered as a percentage of an individuals total wages, scarce oil on the down slope of the curve will take an increasing share of the individuals means to pay for it, so in effect the price of oil to the individual has risen even if the units of exchange have both been reduced. And there are limits to demand destruction. You can reduce food demand from 5000 calories per day down to 2100 per day and fat people will get thinner and healthier but try to reduce it to 1500 per day and you will die. Similarly you can cut fuel consumption on commuting travel and heat buildings to lower temperatures but you must still plant crops and bring the harvest to market and home and that home or at least part of it must be heated to above freezing in winter.emordnilap wrote:

Interestingly, Tverberg sees downward pressure on oil prices.

Even though the cost of extracting oil is increasing, the feedback loops that occur when oil prices actually do rise are such that oil prices tend to quickly fall back, if they actually do rise.

We lived without oil before 1850 so of course we can live without it post 2050 but the problem is that the population in 1850 was about 1.4 billion not the seven plus billion we have today. The demand destruction required to have "Low oil prices" post peak will have to be severe enough to kill off 5.6 billion people.

I expect prices as a percentage of available income to rise steadily year on year spiked with volatility as countries go to war over the remaining supplies.

$102.40 today and riots and revolutions in three hot spots at least.

It looks ominous.

- RenewableCandy

- Posts: 12777

- Joined: 12 Sep 2007, 12:13

- Location: York

I favour the stair step model of oil decline. Supply dries up at current price,

price goes up and oil companies invest in new expensive production. Higher price causes recession and demand falls a bit. The oil companies find that supply exceeds demand a bit, and excluding OPEC fine tuning supply, they find themselves heavily out of pocket as they dump supply at below cost. New drilling stops, depletion takes over, and supply drops.

Next time round a country or two does a Libya or Syria, and supply drops and never comes back. Prices rise.

As for demand destruction, it will be gradual on a global scale, but apocalyptic on a local scale when it hits you. As in Libya, Syria, Iraq, or to a lesser extent Italy, Greece, Portugal etc.

price goes up and oil companies invest in new expensive production. Higher price causes recession and demand falls a bit. The oil companies find that supply exceeds demand a bit, and excluding OPEC fine tuning supply, they find themselves heavily out of pocket as they dump supply at below cost. New drilling stops, depletion takes over, and supply drops.

Next time round a country or two does a Libya or Syria, and supply drops and never comes back. Prices rise.

As for demand destruction, it will be gradual on a global scale, but apocalyptic on a local scale when it hits you. As in Libya, Syria, Iraq, or to a lesser extent Italy, Greece, Portugal etc.

-

vtsnowedin

- Posts: 6595

- Joined: 07 Jan 2011, 22:14

- Location: New England ,Chelsea Vermont

All of that is quite plausible but I think that once the situation is clearly understood more rational approaches will be taken. If prices drop those with the means will buy up the oil reserves still in place and sit on them until the price rises back past their profit point. With world supply dropping five percent a year or more recoverable oil in the ground will rise in value faster then any other investment you could imagine. Wise money is most likely buying up existing reserves at what will soon seem bargain prices as we speak.PS_RalphW wrote:I favour the stair step model of oil decline. Supply dries up at current price,

price goes up and oil companies invest in new expensive production. Higher price causes recession and demand falls a bit. The oil companies find that supply exceeds demand a bit, and excluding OPEC fine tuning supply, they find themselves heavily out of pocket as they dump supply at below cost. New drilling stops, depletion takes over, and supply drops.

Next time round a country or two does a Libya or Syria, and supply drops and never comes back. Prices rise.

As for demand destruction, it will be gradual on a global scale, but apocalyptic on a local scale when it hits you. As in Libya, Syria, Iraq, or to a lesser extent Italy, Greece, Portugal etc.

Once the situation understood is when things will get really irrational. Every major exporter will suddenly find armed insurgents coming out of the woodwork, ideologically inclined to whichever superpower pays them the most. Production will nosedive as in Syria, Libya, Iraq.... Before you know it, it will be rationing and military police at every pump.