Writing the unthinkable in the Telegraph

Moderator: Peak Moderation

-

extractorfan

- Posts: 988

- Joined: 24 Nov 2005, 11:09

- Location: Ricky

- Contact:

They either but more stock or distribute the profit to the shareholders after paying some to the landlord, some to the utility companies and some in wages to the staff.stevecook172001 wrote:Yes, but the people who you paid for your equipment are going to deposit that loaned money of yours into their bank account.extractorfan wrote:I don't know how you factor it in but a lot (most??) loaned money gets invested in ventures that are not bank accounts. Still in the hope of making a return of course, but not simply loaned out again.stevecook172001 wrote:

I'll run another table to simulate that.....

If my business was to take out a loan for example, that money would be spent on equipment, new premises, maybe a couple of new sales people etc.. Assets that we'd hope paid for themselves by attracting new customers.

Guess what happens to it then?

The shareholders may deposit the money, they may invest it in other ways.

So, I don't believe my £100 gets loaned out multiple times. It goes through a long process of distribution and eventually I can imagine that more the 100% of it is reloaned, and I still think this is a very bad thing as it is borrowing from the future, however £900 isn't loaned out for evey £100.

Better regulation is needed. More scrutiny of certain assertions (like in internet documentaries) about how the banking industry works is needed.

Banks should not lend money to governments, governments should spend it into existence.

- emordnilap

- Posts: 14814

- Joined: 05 Sep 2007, 16:36

- Location: here

+1extractorfan wrote:Banks should not lend money to governments, governments should spend it into existence.

They get virtually all of it back in the end anyway through the tax system, apart from the proportion sent to another government's jurisdiction (or not, in the case of the increasing number of tax-avoiding multinationals). All of which points to the need for currency and capital flows to be kept separate anyway.

I experience pleasure and pains, and pursue goals in service of them, so I cannot reasonably deny the right of other sentient agents to do the same - Steven Pinker

-

Little John

Whatever happens to the money on its interim journey from economic agent to economic agent, it will eventually always find it's way into a bank deposit account and when that happens it gets lent out again. The only way that doesn't happen is if someone puts it under their mattress or burns it. In other words, completely removes it from the systemextractorfan wrote:They either but more stock or distribute the profit to the shareholders after paying some to the landlord, some to the utility companies and some in wages to the staff.stevecook172001 wrote:Yes, but the people who you paid for your equipment are going to deposit that loaned money of yours into their bank account.extractorfan wrote: I don't know how you factor it in but a lot (most??) loaned money gets invested in ventures that are not bank accounts. Still in the hope of making a return of course, but not simply loaned out again.

If my business was to take out a loan for example, that money would be spent on equipment, new premises, maybe a couple of new sales people etc.. Assets that we'd hope paid for themselves by attracting new customers.

Guess what happens to it then?

The shareholders may deposit the money, they may invest it in other ways.

So, I don't believe my £100 gets loaned out multiple times. It goes through a long process of distribution and eventually I can imagine that more the 100% of it is reloaned, and I still think this is a very bad thing as it is borrowing from the future, however £900 isn't loaned out for evey £100.

Better regulation is needed. More scrutiny of certain assertions (like in internet documentaries) about how the banking industry works is needed.

Banks should not lend money to governments, governments should spend it into existence.

All other systemic routes, no matter how indirect and tortuous the route, lead back to the banks. Once it gets there it gets lent out again within the fractional reserve ratio constraints. The process is inexorable and inevitable and only comes to a stop when it approaches infinity.

-

extractorfan

- Posts: 988

- Joined: 24 Nov 2005, 11:09

- Location: Ricky

- Contact:

ok yes, I get that but if it goes back into a bank and gets lent out again it's not the same money being lent multimple times from one deposit so that's cleared it up...erm....I think.stevecook172001 wrote:Whatever happens to the money on its interim journey from economic agent to economic agent, it will eventually always find it's way into a bank deposit account and when that happens it gets lent out again. The only way that doesn't happen is if someone puts it under their mattress or burns it. In other words, completely removes it from the system

Banks should not lend money to governments, governments should spend it into existence.

All other systemic routes, no matter how indirect and tortuous the route, lead back to the banks. Once it gets there it gets lent out again within the fractional reserve ratio constraints. The process is inexorable and inevitable and only comes to a stop when it approaches infinity.

I think we've got a good understanding from this thread though. As less work is done and there's less stuff to manufacture because there's less people with money to buy stuff, loans stop being paid back then banks don't have enough cash because they've lent 90% of it out and only have 10% liquidity when people start needing their savings to live on (not just buy "stuff", but food, rent, mortgage or whatever.

Last edited by extractorfan on 01 Nov 2012, 22:17, edited 1 time in total.

- UndercoverElephant

- Posts: 13499

- Joined: 10 Mar 2008, 00:00

- Location: UK

You've invented a new word. "Manged"...yep, that's what our economy is.extractorfan wrote: We should either have free market or a manged economy...

Manged: a combination of mangy and mangled, rhymes with "pranged."

Last edited by UndercoverElephant on 02 Nov 2012, 00:39, edited 2 times in total.

"We fail to mandate economic sanity because our brains are addled by....compassion." (Garrett Hardin)

-

extractorfan

- Posts: 988

- Joined: 24 Nov 2005, 11:09

- Location: Ricky

- Contact:

I am doing exactly that at the moment and I know quite a few people are doing the same to a greater or lesser degree..... for a number of reasons.extractorfan wrote:The only way that doesn't happen is if someone puts it under their mattress or burns it. In other words, completely removes it from the system

Real money is gold and silver

-

extractorfan

- Posts: 988

- Joined: 24 Nov 2005, 11:09

- Location: Ricky

- Contact:

-

Little John

If you look at the system as a whole EF, it really is the same money.extractorfan wrote:ok yes, I get that but if it goes back into a bank and gets lent out again it's not the same money being lent multimple times from one deposit so that's cleared it up...erm....I think.stevecook172001 wrote:Whatever happens to the money on its interim journey from economic agent to economic agent, it will eventually always find it's way into a bank deposit account and when that happens it gets lent out again. The only way that doesn't happen is if someone puts it under their mattress or burns it. In other words, completely removes it from the system

Banks should not lend money to governments, governments should spend it into existence.

All other systemic routes, no matter how indirect and tortuous the route, lead back to the banks. Once it gets there it gets lent out again within the fractional reserve ratio constraints. The process is inexorable and inevitable and only comes to a stop when it approaches infinity.

I think we've got a good understanding from this thread though. As less work is done and there's less stuff to manufacture because there's less people with money to buy stuff, loans stop being paid back then banks don't have enough cash because they've lent 90% of it out and only have 10% liquidity when people start needing their savings to live on (not just buy "stuff", but food, rent, mortgage or whatever.

But there is an even more important implication that occurs to me;

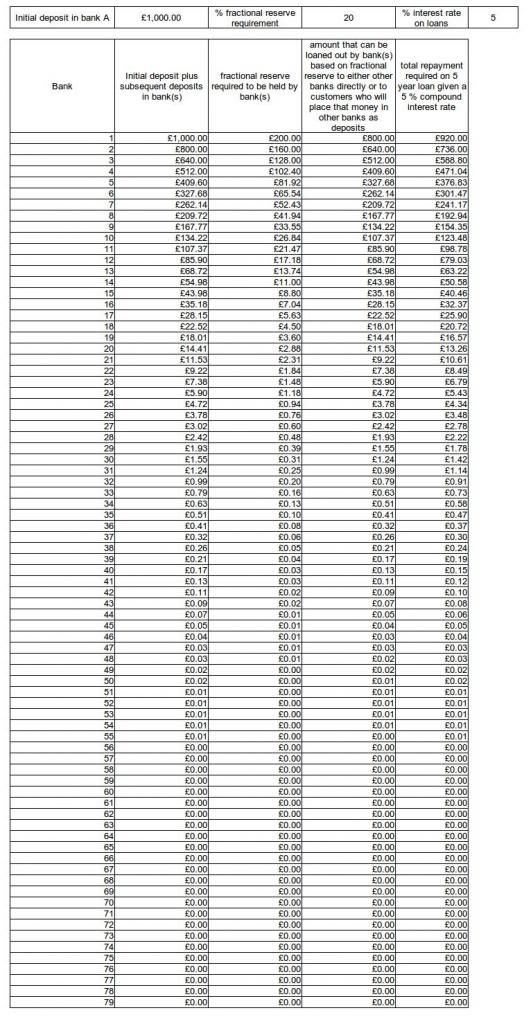

If we go back to that last table and assume an average interest rate of, say, 5% on all of the loans throughout the system, this mean that there will be a total amount of money that is required to be paid back in order that all loans are paid off properly. Below, is a table to account for that. It includes a column of the total repayment on each of the loans based on a 5 year loan on a 5% compound interest rate.

This table shows that the total amount of money required to pay the loans is £4600.

So, starting from a baseline figure of 1000 central bank money, we end up with a situation where the total amount of money in the system is £4000 and that the system must grow over the next 5 years by another £600 just to make the books balance at the end of that period.

Presumably, the only way the above can be made to work is if the central bank continues to lend money into the system to cover the hole in the balance sheet implied by interest rates on loans. But, of course, the banks are simply going to lend out any new money that comes into the system and so the problem keeps on growing.

All of the above is the reason why governments shit themselves when growth stops because, when that happens, the ponzi-scheme money-supply promptly collapses. However, they can't allow it to collapse and so they keep pushing money into the system regardless. The trouble is, this new money no longer has an economic home to go to (due to halted growth) and so merely has the effect of causing inflationary driven prices rises due to the oversupply of money. This is why recessions often bring inflationary price rises with them instead of deflationary collapses in prices, which is what one might have intuitively expected.

I have worked out that the central bank base money supply will need to grow to £1150 in 5 year's time to cover the interest repayments on the loans and this means that there is a built in requirement that the economy will grow by 3% per year for each of those 5 years to accommodate the extra money flowing into the system. Any growth less than that and you end up either with deflation (if the CB does not create enough base money) or inflation (if the CB does create the money). Th only way you avoid either inflation or deflation is if the economy grows by just the right amount. Whatever happens, the economy must perpetually grow in order for this type of FRB-based money-supply to work.

In short, an FRB-based money-supply is always a car-crash waiting to happen and on a finite planet of finite resource you can be guaranteed it will happen (due to the limits to growth implied by those finite resources).

It's happening right now.

Last edited by Little John on 02 Nov 2012, 08:59, edited 6 times in total.

-

extractorfan

- Posts: 988

- Joined: 24 Nov 2005, 11:09

- Location: Ricky

- Contact:

But that initial £800 loan doesn't do directly into a bank account, it's for something probably (possibly) tangible. nobody borrows in order to just put the money in a bank. The £800 goes on a long journey, and yes, eventually the £800 and some more money that it may have attracted (or less if it lost money) ends up back in a bank at some point, well varying points as it gets split up, some of it ends up in HMRC's coffers.

So whilst I agree that private banks can create money, by what i would call dodgy accounting (it's probably legal though), I don't believe that the banks are all working together to make £1000 immediately = £4000. I accept that in theory it could happen but if it doesn't go into the economy I don't see the point in inflating the money supply in this way, because even the rich would get poorer in real terms due to very high or hyper inflation. Perhapse this is why quantative easing didn't end up in the economy, so perhapse some complicated mechanism like this happened to balance the books, but as a general practice I just can't see it.

So because something seems possible, doesn't automatically mean it is actually going on, who would benefit? The bankers wouldn't benefit (in "normal" times) because they're just devaluing the money. I can see the benefit in the credit crunch because it would stop them going bust.

Something I feel is only slightly relevant to this. I know a person who started a picture framing business, had a good business plan and an ideal start up for the government initiative that would guarantee the loan she wanted from the bank. The bank simple wouldn't put it forward for the governemnt intitiative (can't remember its name) but has still not agreed to loan the money, and its looking less and less likely that it will. I may be paraniod, but why would a bank not try to make money out of a risky venture, if the taxpayer would cover all the risk? Regardless, it doesn't even seem a risky venture to me, they already have the equipment, just need to fund premises. Sorry, I know that's not about the money supply / fractional reserve thing.

So whilst I agree that private banks can create money, by what i would call dodgy accounting (it's probably legal though), I don't believe that the banks are all working together to make £1000 immediately = £4000. I accept that in theory it could happen but if it doesn't go into the economy I don't see the point in inflating the money supply in this way, because even the rich would get poorer in real terms due to very high or hyper inflation. Perhapse this is why quantative easing didn't end up in the economy, so perhapse some complicated mechanism like this happened to balance the books, but as a general practice I just can't see it.

So because something seems possible, doesn't automatically mean it is actually going on, who would benefit? The bankers wouldn't benefit (in "normal" times) because they're just devaluing the money. I can see the benefit in the credit crunch because it would stop them going bust.

Something I feel is only slightly relevant to this. I know a person who started a picture framing business, had a good business plan and an ideal start up for the government initiative that would guarantee the loan she wanted from the bank. The bank simple wouldn't put it forward for the governemnt intitiative (can't remember its name) but has still not agreed to loan the money, and its looking less and less likely that it will. I may be paraniod, but why would a bank not try to make money out of a risky venture, if the taxpayer would cover all the risk? Regardless, it doesn't even seem a risky venture to me, they already have the equipment, just need to fund premises. Sorry, I know that's not about the money supply / fractional reserve thing.

-

Little John

They'll just print up money to replace it.snow hope wrote:I am doing exactly that at the moment and I know quite a few people are doing the same to a greater or lesser degree..... for a number of reasons.extractorfan wrote:The only way that doesn't happen is if someone puts it under their mattress or burns it. In other words, completely removes it from the system

-

kenneal - lagger

- Site Admin

- Posts: 14290

- Joined: 20 Sep 2006, 02:35

- Location: Newbury, Berkshire

- Contact:

All this has been explained in Money as Debt!! Steve has proven to himself, and a few others, that the Money as Debt concept of banks printing money is true so why not accept the rest?

If I get a loan from my bank to buy a car, say, I pay that loan over to the seller and they put it in their bank. Their bank then lends it out and so on.... If I pay cash that cash then gets spent in a shop who put it in the bank who then lend it out ..... The money gets into the banking system sooner or later and the cycle repeats itself. Very few people, except maybe, a few on this board keep money under their mattress any more; it all gets put in the bank or spent.

Money as Debt also says that the current system has people running on the treadmill of growth trying to keep up but that many fall off, unable to repay their loans. There is only enough money in the system at any one time to repay the capital on the loans. Growth must happen to repay the interest as well. In times of recession the money supply actually reduces as some people pay off their loans and the money literally is wiped off the banks books. That makes it more difficult for others to repay their loans because their is less money in the system that people can earn.

So debt repayment falters and the banks are then unwilling to loan to business because they know that there isn't the money around to repay loans. The government has been pumping money into the banks so that they can cover these losses. The £350 billion or so that the BOE has pumped in so far is only enough to cover the losses not enough to enable them to make new loans. That's how bad things are.

If I get a loan from my bank to buy a car, say, I pay that loan over to the seller and they put it in their bank. Their bank then lends it out and so on.... If I pay cash that cash then gets spent in a shop who put it in the bank who then lend it out ..... The money gets into the banking system sooner or later and the cycle repeats itself. Very few people, except maybe, a few on this board keep money under their mattress any more; it all gets put in the bank or spent.

Money as Debt also says that the current system has people running on the treadmill of growth trying to keep up but that many fall off, unable to repay their loans. There is only enough money in the system at any one time to repay the capital on the loans. Growth must happen to repay the interest as well. In times of recession the money supply actually reduces as some people pay off their loans and the money literally is wiped off the banks books. That makes it more difficult for others to repay their loans because their is less money in the system that people can earn.

So debt repayment falters and the banks are then unwilling to loan to business because they know that there isn't the money around to repay loans. The government has been pumping money into the banks so that they can cover these losses. The £350 billion or so that the BOE has pumped in so far is only enough to cover the losses not enough to enable them to make new loans. That's how bad things are.

Last edited by kenneal - lagger on 02 Nov 2012, 17:50, edited 1 time in total.

Action is the antidote to despair - Joan Baez

-

extractorfan

- Posts: 988

- Joined: 24 Nov 2005, 11:09

- Location: Ricky

- Contact:

Yes, but you pay that loan back to your bank out of future earnings. The shop might put the profit in the bank, but they'll use the rest to replenish the stock OR they'll but more stock. The profit they might pay to builders to refurbish the shop. The builders might put it in the bank but probably not as they don't like tracable transactions.kenneal - lagger wrote:

If I get a loan from my banks to buy a car, say, I pay that loan over to the seller and they put it in their bank. Their bank then lends it out and so on.... If I pay cash that cash then gets spent in a shop who put it in the bank who then lend it out ..... The money gets into the banking system sooner or later and the cycle repeats itself. Very few people, except maybe, a few on this board keep money under their mattress any more; it all gets put in the bank or spent.

I dunno, maybe I'll watch the money as debt video again at some point. I though we'd been convinced that £1000 doesn't get loaned out 4x, because some, or all, or most of it is paid back beofre the rest that is spent gets into a bank elsewhere.

To be honest, I'm not even sure it matters apart from the issue keeps cropping up here. At some point, growth stops because of natural constraints. That;s all that really matters, that and how the hell we deal with it, if in fact we even try.

-

kenneal - lagger

- Site Admin

- Posts: 14290

- Joined: 20 Sep 2006, 02:35

- Location: Newbury, Berkshire

- Contact:

If you spend money in a shop or bar, they cash up at the end of the day and put the money in the bank. As soon as that money hits the bank it can be lent out again (or the proportion of it that FRB allows - 89% I think).

The fact that the shop might spend some of it the next day to replenish their stock is covered by the fact that someone else puts money into the bank the next day. The bank cashes up and then their surplus is lent out. That's how the cash economy works.

Most money never sees the cash economy because it's all done electronically. Think about most of your spending: mortgage, rent, rates, car loan repayments. They never see the light of day and are just key strokes on a computer. A bank cashes up at the end of the day and any surplus is loaned out overnight on the markets. This stopped with the crash and it was quite time before the banks would trust each other and I don't think that they do even now, possibly less now than earlier.

The fact that the shop might spend some of it the next day to replenish their stock is covered by the fact that someone else puts money into the bank the next day. The bank cashes up and then their surplus is lent out. That's how the cash economy works.

Most money never sees the cash economy because it's all done electronically. Think about most of your spending: mortgage, rent, rates, car loan repayments. They never see the light of day and are just key strokes on a computer. A bank cashes up at the end of the day and any surplus is loaned out overnight on the markets. This stopped with the crash and it was quite time before the banks would trust each other and I don't think that they do even now, possibly less now than earlier.

Action is the antidote to despair - Joan Baez