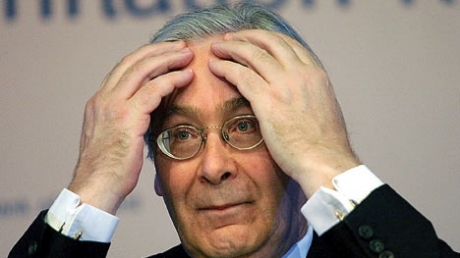

I'm growing a soft spot for poor old Mervyn. It's pretty obvious he knows what is coming, and he is trying to warn people...sort of.Aurora wrote:... and as for the UK?

BBC News - 16/05/12

The eurozone was "tearing itself apart" and the UK would not be "unscathed", said Bank governor Sir Mervyn King.

Article continues ...

Greece Watch...

Moderator: Peak Moderation

- UndercoverElephant

- Posts: 13496

- Joined: 10 Mar 2008, 00:00

- Location: UK

"We fail to mandate economic sanity because our brains are addled by....compassion." (Garrett Hardin)

-

Aurora

In his latest report, this is what Merv had to say about oil:

See: http://www.bankofengland.co.uk/publicat ... r12may.pdfOil prices rose sharply around the time of the February Report

but have fallen back in recent weeks (Chart 4.3). The initial

increase in oil prices was likely to have reflected developments

in oil supply rather than positive news on global demand, as

other commodity prices were largely unchanged over that

period (Chart 4.3). Indeed, there were some disruptions to

actual oil production, such as those in South Sudan. And there

were also concerns about future oil supplies, in part due to

political tensions in the Middle East — particularly the EU

embargo on Iranian oil exports, which is likely to reduce overall

market capacity. The fallback in oil prices over recent weeks is

likely to have reflected weaker global demand prospects

together with some easing in those concerns over oil supply.

Those demand and supply considerations will be reflected in

the spot and futures prices of oil. In the fifteen days running

up to the May Report, the spot price and futures curve, in

sterling terms, were broadly back to their levels at the time of

the February Report (Chart 4.4), suggesting a small decline in

the price of oil over the next couple of years. But there are

risks around that profile. An intensification of concerns about

future oil supply could raise oil prices. But they could fall

further if world demand prospects weaken. Movements in the

prices of option contracts suggest that the relative weight that

market participants attach to a rise in oil prices has fallen in

recent weeks (Chart 4.5).

Last edited by Aurora on 17 May 2012, 07:19, edited 1 time in total.

-

Aurora

The Guardian - 16/05/12

How Greece's exit from the euro would affect UK consumers

As the eurozone crisis intensifies, we look at the impact a Greek exit would have on savers, spenders and speculators.

Article continues ...

- emordnilap

- Posts: 14815

- Joined: 05 Sep 2007, 16:36

- Location: here

On the subject of boating, we've always a minister or two up for a gaffe:

http://www.broadsheet.ie/2012/05/16/the ... el-noonan/

Solidarity, comrades!

http://www.broadsheet.ie/2012/05/16/the ... el-noonan/

Solidarity, comrades!

I experience pleasure and pains, and pursue goals in service of them, so I cannot reasonably deny the right of other sentient agents to do the same - Steven Pinker

-

Aurora

emordnilap wrote:On the subject of boating, we've always a minister or two up for a gaffe:

http://www.broadsheet.ie/2012/05/16/the ... el-noonan/

Solidarity, comrades!

-

Aurora

The Guardian - 17/05/12

Cost of Greek exit from euro put at $1tn

UK government making urgent preparations to cope with the fallout of a possible Greek exit from the single currency.

Article continues ...

-

Aurora

A leading German economist has suggested a Greek exit from the euro would be better for both Greece and the eurozone.

Hans-Werner Sinn, head of the Munich-based Ifo institute, said that in order to stay in the euro, Athens would have to cut prices and wages by 30-40% to make its goods competitive, but could not do so because it would bring Greece to the "brink of civil war".

"The Greeks must give up the euro as quickly as possible and reinstate the drachma," he told the Rheinische Post.

-

Aurora

P.S. Don't forget to watch Pesto's program @ 9.00pm on BBC2 this evening.The Guardian - 17/05/12

German stance on Greek crisis softens as eurozone fears mount

Angela Merkel, under pressure to ease her austerity fixation, has said she is open to stimulus measures to help Greeks.

Article continues ...

Greece downgraded to CCC credit rating by Fitch

http://www.guardian.co.uk/business/2012 ... -euro-exit

Threatens to put all Eurozone soverign ratings on negative watch.

http://www.guardian.co.uk/business/2012 ... -euro-exit

Threatens to put all Eurozone soverign ratings on negative watch.

- UndercoverElephant

- Posts: 13496

- Joined: 10 Mar 2008, 00:00

- Location: UK

Which just goes to show how ridiculous the ratings are.RalphW wrote:Greece downgraded to CCC credit rating by Fitch

http://www.guardian.co.uk/business/2012 ... -euro-exit

Threatens to put all Eurozone soverign ratings on negative watch.

http://en.wikipedia.org/wiki/Fitch_Group

Greece is D, not CCC.BB : more prone to changes in the economy

B : financial situation varies noticeably

CCC : currently vulnerable and dependent on favorable economic conditions to meet its commitments

CC : highly vulnerable, very speculative bonds

C : highly vulnerable, perhaps in bankruptcy or in arrears but still continuing to pay out on obligations

D : has defaulted on obligations and Fitch believes that it will generally default on most or all obligations

NR : not publicly rated

"We fail to mandate economic sanity because our brains are addled by....compassion." (Garrett Hardin)

- UndercoverElephant

- Posts: 13496

- Joined: 10 Mar 2008, 00:00

- Location: UK

http://www.reuters.com/article/2012/05/ ... W720120516

If all else fails, conspire to shoot the messengers.

* Italian banks want ratings ignored after mass downgrade

* European banks meet to discuss curbing raters' powers

By Arno Schuetze and Gianluca Semeraro

FRANKFURT/MILAN, May 16 (Reuters) - Italian banks struck back at credit agencies after Monday's mass downgrade by asking local and European regulators to disregard their credit ratings, while Europe's biggest lenders met to discuss curbing raters' powers.

If all else fails, conspire to shoot the messengers.

"We fail to mandate economic sanity because our brains are addled by....compassion." (Garrett Hardin)

-

kenneal - lagger

- Site Admin

- Posts: 14290

- Joined: 20 Sep 2006, 02:35

- Location: Newbury, Berkshire

- Contact:

- UndercoverElephant

- Posts: 13496

- Joined: 10 Mar 2008, 00:00

- Location: UK