Energy Markets Outlook - December 2008

Moderator: Peak Moderation

Energy Markets Outlook - December 2008

Has anybody seen this report? (Sorry if it has aleady been posted but don't think it has)

Came across it on the BERR site - seems to be a very recent addition - have only read the Executive Summary so far...... but there seems to be lots more detail.

http://www.berr.gov.uk/whatwedo/energy/ ... 41839.html

Do you think the Gov't is starting to catch on yet??

Came across it on the BERR site - seems to be a very recent addition - have only read the Executive Summary so far...... but there seems to be lots more detail.

http://www.berr.gov.uk/whatwedo/energy/ ... 41839.html

Do you think the Gov't is starting to catch on yet??

Real money is gold and silver

I've read the nuclear and oil sections. I think it's very poor! In the nuclear section they don't once mention the fact that annual production of uranium is less than annual consumption. In the oil section they do address peak oil - but, and this is great, not in a numbered paragraph. The whole issue of peak oil gets its own box out of the way at the end of the report. While at the front of the report we're told about the decades of R/P ratio we've got.

There seems to have been virtually no improvement in their position over the several years I've been reading this reports.

There seems to have been virtually no improvement in their position over the several years I've been reading this reports.

- RenewableCandy

- Posts: 12777

- Joined: 12 Sep 2007, 12:13

- Location: York

You have to understand where this comes from.

This report is meant to replace the work of the Joint Energy Security of Supply (JESS) committee -- but it has various anomalies, the biggest one being it doesn't anticipate the present level of demand destruction due to the recession. It also uses the government's silly future estimates of energy prices, so it doesn't reflect the future level of demand destruction/lower growth due to higher prices.

Saying that, it probably is fairly OK in terms of it's estimates for UK resource depletion, which is the key variable that is going to stuff teh economy.

This report is meant to replace the work of the Joint Energy Security of Supply (JESS) committee -- but it has various anomalies, the biggest one being it doesn't anticipate the present level of demand destruction due to the recession. It also uses the government's silly future estimates of energy prices, so it doesn't reflect the future level of demand destruction/lower growth due to higher prices.

Saying that, it probably is fairly OK in terms of it's estimates for UK resource depletion, which is the key variable that is going to stuff teh economy.

You're writing in February 09; the report reports as at about October 08, at which point the extent of the economic downturn and, more to the point, statistics on its impact on energy consumption weren't yet available.mobbsey wrote:You have to understand where this comes from.

This report is meant to replace the work of the Joint Energy Security of Supply (JESS) committee -- but it has various anomalies, the biggest one being it doesn't anticipate the present level of demand destruction due to the recession. It also uses the government's silly future estimates of energy prices, so it doesn't reflect the future level of demand destruction/lower growth due to higher prices.

Saying that, it probably is fairly OK in terms of it's estimates for UK resource depletion, which is the key variable that is going to stuff teh economy.

The projections of future demand levels for electricity and gas aren't the Government's, they are National Grid's, and National Grid aren't under any obligation to use the Government's price projections. In any case I am not sure that the government's price projections do look so silly now. After all, energy prices are presently falling. Who on this forum can refer us back to their posting from last summer where they accurately predicted where energy prices would be by now?

And the report shows very clearly that there is a wide range of possible future trends in demand, some of them falling from previous levels, others rising, in both electricity and gas, influenced by a wide range of factors of which price is only one.

I was on the right track. See this thread from April 2007:Keepz wrote:Who on this forum can refer us back to their posting from last summer where they accurately predicted where energy prices would be by now?

http://www.powerswitch.org.uk/forum/vie ... php?t=4037

clv101 wrote:There is no guarantee of high oil prices post peak. My expectation is that the economy will react with greater magnitude than the geology. For example a 5% oil supply contraction may lead to a 10% demand contraction through recession representing a 5% oversupply and low prices. Believing oil supply will peak in say 2010 is not the same as believing investing in 2012 futures is easy money.The BNP wrote:"In the coming world economic slowdown or recession, the oil price is likely to fall further as energy demand falls, although probably not back to $20."

Seems the BNP and myself were right. Demand has fallen away faster than supply.clv101 wrote:Yeah but there doesn't have to be much of a recession, people don't have to get much poorer before demand falls away a lot. I just think demand will fall away faster than supply. All that new demand in China could dry up over night if the West stops importing wigits, how much less driving would there be in the UK if unemployment reached 20%? Look what happened to Russian oil consumption with the Soviet collapse!snow hope wrote:...I really can't see oil being at "conventional" levels ever again - it is just too important to too many people.

-

Blue Peter

- Posts: 1939

- Joined: 24 Nov 2005, 11:09

- Location: Milton Keynes

However, am I reading this pice from the oil drum correctly?clv101 wrote: Seems the BNP and myself were right. Demand has fallen away faster than supply.

Khebab

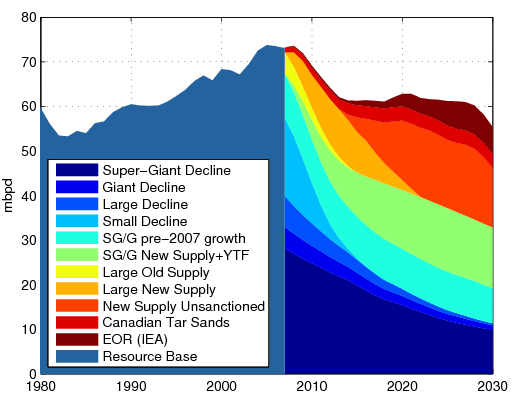

Particularly this graph:

Which is suggesting a very steep cliff (10% decline), imminently. Demand and supply may fall together, but it suggests that there can be no recovery to 2007 levels,

Peter.

Does anyone know where the love of God goes when the waves turn the seconds to hours?

Fine; so what is so silly about the Government's price projections?clv101 wrote:I was on the right track. See this thread from April 2007:Keepz wrote:Who on this forum can refer us back to their posting from last summer where they accurately predicted where energy prices would be by now?

http://www.powerswitch.org.uk/forum/vie ... php?t=4037

clv101 wrote:There is no guarantee of high oil prices post peak. My expectation is that the economy will react with greater magnitude than the geology. For example a 5% oil supply contraction may lead to a 10% demand contraction through recession representing a 5% oversupply and low prices. Believing oil supply will peak in say 2010 is not the same as believing investing in 2012 futures is easy money.The BNP wrote:"In the coming world economic slowdown or recession, the oil price is likely to fall further as energy demand falls, although probably not back to $20."Seems the BNP and myself were right. Demand has fallen away faster than supply.clv101 wrote:Yeah but there doesn't have to be much of a recession, people don't have to get much poorer before demand falls away a lot. I just think demand will fall away faster than supply. All that new demand in China could dry up over night if the West stops importing wigits, how much less driving would there be in the UK if unemployment reached 20%? Look what happened to Russian oil consumption with the Soviet collapse!snow hope wrote:...I really can't see oil being at "conventional" levels ever again - it is just too important to too many people.

-

kenneal - lagger

- Site Admin

- Posts: 14290

- Joined: 20 Sep 2006, 02:35

- Location: Newbury, Berkshire

- Contact:

They are too high because they didn't take into account any recession, let alone the depression we are about to experience, by all accounts.Keepz wrote:Fine; so what is so silly about the Government's price projections?

If the world had a mild recession with a quick recovery the government's price projections might well have been too low as demand increased on recovery and briefly exceeded supply before plunging us into another recession.

The government's figures were based on BAU with fairly steady economic growth. And that wasn't going to happen. But I don't think anyone envisaged such a comprehensive collapse of the system so early.

Action is the antidote to despair - Joan Baez

Yes were are aware that Uranium is relatively common, RGR - however that is not the whole story. From the World Nuclear Association:

"After a decade of falling mine production to 1993, output has generally risen since then and now meets 64% of demand for power generation."

http://www.world-nuclear.org/info/inf23.html

This page you may also find interesting, as it is the same organisation's extensive rubbishing of the Limits to Growth arguement, complete with obligatory Malthus comparison.

http://www.world-nuclear.org/info/inf75.html

From that page they note, in defense of some other point regarding the cost of exploration, that the time from discovery to profit is 10-15 years.

Finally, an interesting last paragraph from the report: "From a detached viewpoint all this may look like mere technological optimism. But to anyone closely involved it is obvious and demonstrable. Furthermore, it is illustrated by the longer history of human use of the Earth's mineral resources. Abundance, scarcity, substitution, increasing efficiency of use, technological breakthroughs in discovery, recovery and use, sustained incremental improvements in mineral recovery and energy efficiency - all these comprise the history of minerals and humankind."

"After a decade of falling mine production to 1993, output has generally risen since then and now meets 64% of demand for power generation."

http://www.world-nuclear.org/info/inf23.html

This page you may also find interesting, as it is the same organisation's extensive rubbishing of the Limits to Growth arguement, complete with obligatory Malthus comparison.

http://www.world-nuclear.org/info/inf75.html

From that page they note, in defense of some other point regarding the cost of exploration, that the time from discovery to profit is 10-15 years.

Finally, an interesting last paragraph from the report: "From a detached viewpoint all this may look like mere technological optimism. But to anyone closely involved it is obvious and demonstrable. Furthermore, it is illustrated by the longer history of human use of the Earth's mineral resources. Abundance, scarcity, substitution, increasing efficiency of use, technological breakthroughs in discovery, recovery and use, sustained incremental improvements in mineral recovery and energy efficiency - all these comprise the history of minerals and humankind."

-

kenneal - lagger

- Site Admin

- Posts: 14290

- Joined: 20 Sep 2006, 02:35

- Location: Newbury, Berkshire

- Contact:

From http://www.world-nuclear.org/how/default.aspx

So, more nasty stuff left lying around leaching into the environment.Getting uranium from the ground

The original ore may contain as little as 0.1% uranium.

The remainder of the ore, containing most of the radioactivity and nearly all the rock material, becomes tailings, which are placed in engineered facilities near the mine (often in mined out pits). Tailings contain long-lived radioactive materials in low concentrations and toxic materials such as heavy metals; however, the total quantity of radioactive elements is less than in the original ore, and their collective radioactivity will be much shorter-lived. These materials need to be isolated from the environment. (my emphasis)

It's no wonder that nuclear power is no longer thought "Too cheap to meter." Just what are the total energy costs of nuclear?Conversion and Enrichment

Uranium found in nature consists largely of two isotopes, U-235 and U-238. The production of energy in the form of heat in nuclear reactors is from the `fission' or splitting of the U-235 atoms. Natural uranium contains 0.7% of the U-235 isotope. The remaining 99.3% is mostly the U-238 isotope which does not contribute directly to the fission process.

Sounds so simple doesn't it? Is that why the UK decommissioning bill is likely to be over £70billion. I wonder if the French have taken on that bill with the sites they have just bought?Decommissioning

Demolition and Site Clearance

* Nuclear Reactors: the final stage of reactor dismantling is completed, buildings demolished and radioactive wastes removed to storage or disposal facilities. The site may then be delicensed and released for appropriate alternative use. No further inspection or monitoring is required.

Action is the antidote to despair - Joan Baez

- biffvernon

- Posts: 18538

- Joined: 24 Nov 2005, 11:09

- Location: Lincolnshire

- Contact:

- RenewableCandy

- Posts: 12777

- Joined: 12 Sep 2007, 12:13

- Location: York

We don't have to. With all our nuke sites on the coast, the sea will wash it all awaybiffvernon wrote:For that sort of decommissioning we'd need to be sure of a society and economy that is capable of doing it. Can we absolutely guarantee that in a warmed world scenario with ~80% dieoff as envisage by Lovelock et al this will happen?