Budget

Moderator: Peak Moderation

Ralph

There are two giant holes in that theory.

Firstly, your yacht wont be bigger than your neighbours if you pay 70% tax and they pay 30%.

Secondly, people might "give up" after their first million. 90% of the second million is 0 if its never earned.

I know people who work three or four day weeks, they'd rather spend the days golfing or gardening than pay 40% tax.

I know someone who works a 5 day week, but pays more into his pension pot than I earn. Same reason, why pay 40% tax when he can pay it into his SIPP and invest in his stables or his classic car restoration company, or his actual retirement.

Seems bonkers to have £60 now, when he could have £80 in a few years time after he retires.

Clv

Maybe, maybe not.

Individualy the poor will pay less, the middle more, the rich less.

But if the lower rate leads to fewer avoidance measures like Ken Livingston uses, the rich might pay a greater amount of tax than they do currently.

There are two giant holes in that theory.

Firstly, your yacht wont be bigger than your neighbours if you pay 70% tax and they pay 30%.

Secondly, people might "give up" after their first million. 90% of the second million is 0 if its never earned.

I know people who work three or four day weeks, they'd rather spend the days golfing or gardening than pay 40% tax.

I know someone who works a 5 day week, but pays more into his pension pot than I earn. Same reason, why pay 40% tax when he can pay it into his SIPP and invest in his stables or his classic car restoration company, or his actual retirement.

Seems bonkers to have £60 now, when he could have £80 in a few years time after he retires.

Clv

Maybe, maybe not.

Individualy the poor will pay less, the middle more, the rich less.

But if the lower rate leads to fewer avoidance measures like Ken Livingston uses, the rich might pay a greater amount of tax than they do currently.

I'm a realist, not a hippie

-

Blue Peter

- Posts: 1939

- Joined: 24 Nov 2005, 11:09

- Location: Milton Keynes

They might do, but in general, the rich seem to go to a lot of effort to get richer,DominicJ wrote:Ralph

Secondly, people might "give up" after their first million. 90% of the second million is 0 if its never earned.

Peter.

Does anyone know where the love of God goes when the waves turn the seconds to hours?

Isn't that what Putin did a few years ago? Slashed income tax to 13% and actually increased revenue?DominicJ wrote:..if the lower rate leads to fewer avoidance measures ... the rich might pay a greater amount of tax than they do currently.

I remember an accountant I used to know telling me that here in the UK, if income tax were to be cut to around 13%, it would no longer be worth (as in 'financially viable') employing people like him to work out how best to avoid paying taxes, thus overall revenue would increase and accountants would starve.The Russian government revealed recently that the 13% flat tax rate imposed last year on individual taxpayers has been a resounding success, with personal income tax revenue up nearly 47% in 2001.

http://www.tax-news.com/news/More_Russi ... _7904.html

What's not to like?

-

stumuzz

I read somewhere, I think it was Alastair Cook's letter from America, that the US had a tax rate for a short time of 17% on all collected tax. During that time the percentage tax take from the economy had never been higher.

However, for political reasons it was fiddled with and the tax take went down.

Imagine the howls of fury if the tax was reduced to 17%.

However, for political reasons it was fiddled with and the tax take went down.

Imagine the howls of fury if the tax was reduced to 17%.

There was an interesting piece of recent research that questions this axiom:Blue Peter wrote:.. the rich seem to go to a lot of effort to get richer.

In other words, there's a systemic driver toward concentrating wealth - if you're rich, getting richer takes less effort. Inverse and non-linear.The finding suggests that the basic inequality in wealth distribution seen in most societies may have little to do with differences in the backgrounds and talents of their citizens. Rather, the disparity appears to be something akin to a law of economic life that emerges naturally as an organizational feature of a network.

Shades of inequality

Bouchaud and Mézard's discovery suggests that the temptation to find complex explanations behind the distribution of wealth may be seriously misguided. What makes wealth fall into the pockets of a few appears to be quite simple. On the one hand, transactions between people tend to spread wealth around. If one person becomes dramatically wealthy, she may start a business, build a house, and consume more products, and in each case wealth will tend to flow out to others in the network. Conversely, if a person becomes terribly poor, he will tend to purchase fewer products, and less wealth will flow through links going away from him. Overall, the flow of funds along links in the network should act to wash away wealth disparities.

But it seems that this washing out effect never manages to gain the upper hand, for the random returns on investment drive a counterbalancing rich-get-richer phenomenon. Even if everyone starts out equal, differences in investment luck will cause some people to start to accumulate more wealth than others. Those who are lucky will tend to invest more and so have a chance to make greater gains still. Hence, a string of positive returns builds a person's wealth not merely by addition but by multiplication, as each subsequent gain grows ever bigger. This is enough, even in a world of equals where returns on investment are entirely random, to stir up huge wealth disparities in the population.

http://hbswk.hbs.edu/archive/2906.html

Obvious to the point of banality, perhaps - but nice to have the research to back it up.

- emordnilap

- Posts: 14814

- Joined: 05 Sep 2007, 16:36

- Location: here

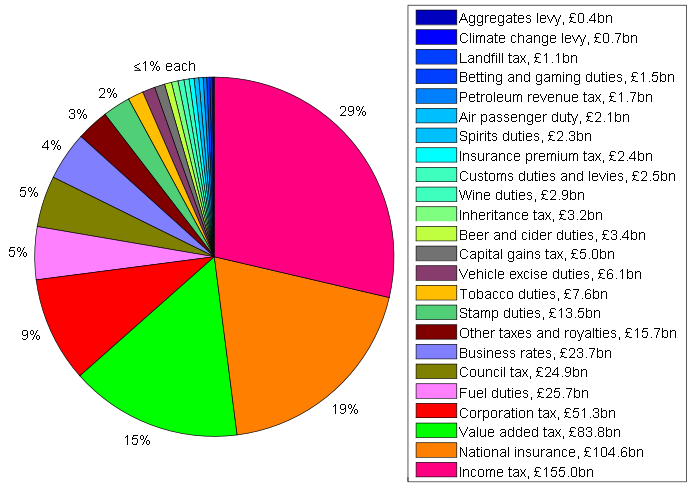

I don't know how much of the total tax take comes from income tax anyway.

What are the major sources of tax income?

Income tax/National insurance

VAT

Council tax/ stamp duty/income from government owned property

Excise duty of alcohol and cigarettes and petrol/diesel

Importation taxes.

Capital gains tax

Inheritance taxes

corporation tax

Tax on oil/gas companies

Licences for electromagnetic spectrum/mineral extraction/land fill taxes etc.

The list goes on and on.

I guess that about 50% of GDP is funnelled government tax, although a lot of this get recycled as wages which are again taxed, etc, and some of it is returned to the private sector by buying goods and services.

We spend a lot of time focused on income tax, but for most people VAT is a huge , regressive tax.

What are the major sources of tax income?

Income tax/National insurance

VAT

Council tax/ stamp duty/income from government owned property

Excise duty of alcohol and cigarettes and petrol/diesel

Importation taxes.

Capital gains tax

Inheritance taxes

corporation tax

Tax on oil/gas companies

Licences for electromagnetic spectrum/mineral extraction/land fill taxes etc.

The list goes on and on.

I guess that about 50% of GDP is funnelled government tax, although a lot of this get recycled as wages which are again taxed, etc, and some of it is returned to the private sector by buying goods and services.

We spend a lot of time focused on income tax, but for most people VAT is a huge , regressive tax.

-

Blue Peter

- Posts: 1939

- Joined: 24 Nov 2005, 11:09

- Location: Milton Keynes

Worth reading the Archdruid this week as well:Mr. Fox wrote:In other words, there's a systemic driver toward concentrating wealth - if you're rich, getting richer takes less effort. Inverse and non-linear.

Obvious to the point of banality, perhaps - but nice to have the research to back it up.

To make sense of this, it’s necessary to glance back at Alf Hornborg’s analysis of industrial production as a system of wealth concentration. To build and maintain an industrial system takes vast amounts of capital, since factories don’t come cheap. All that capital has to be extracted from the rest of the economy, placed in the hands of a few magnates, and kept there, in order for an industrial economy to come into being and sustain itself. That’s why, in a market economy, the technological dimension of industrialism—the replacement of human labor with machines—is always paired with the economic and social dimension of industrialism—the creation of unequal patterns of exchange that concentrate wealth in the hands of factory owners at the expense of workers, farmers, and pretty much everybody else. The exact mechanisms used to impose and maintain those unequal exchanges vary from case to case, but some such mechanism has to be there, because an economy that allows the wealth produced by an industrial system to spread out through the population pretty quickly becomes an economy that no longer has the concentrated capital an industrial system needs to survive.

Peter.

Does anyone know where the love of God goes when the waves turn the seconds to hours?

RalphW wrote:I don't know how much of the total tax take comes from income tax anyway.

http://en.wikipedia.org/wiki/File:UK_taxes.svg

Thanks Peter - well worth reading.Blue Peter wrote:Worth reading the Archdruid this week as well:

That’s overproduction. In the Long Depression, as in the Great Depression, it was an everyday reality, driving, severe deflation and high unemployment, and we’d still be talking about it today if Marx hadn’t been turned into an intellectual figurehead for one side in the bare-knuckle brawl over global power that dominated the second half of the 20th century.

*chuckle & nod*

-

Further to Chris's pie chart, this gives an indication as to how the UK compares with the rest of the world:

http://en.wikipedia.org/wiki/Tax_rates_around_the_world