BBC News - 16/07/12

The global economic recovery is still at risk, and eurozone economies remain in a "precarious" situation, the International Monetary Fund has said.

A delayed or insufficient response from European leaders to the crisis would further derail the recovery, it said.

The IMF downgraded its forecast for global growth for 2013 to 3.9% from the 4.1% prediction it made in April.

Article continues ...

The Eurozone crisis/break-up may crash the system?

Moderator: Peak Moderation

-

Aurora

- energy-village

- Posts: 1054

- Joined: 22 Apr 2008, 22:44

- Location: Yorkshire, UK

What is a crisis? Quick google.

What we're going through now should not really be a 'surprise' and I assume the 'important goals' envisaged are further growth. Even in the best scenario how long can that go on given we live on a little planet with a booming population?Seeger, Sellnow and Ulmer:

Includes:

1. unexpected (i.e., a surprise)

2. creates uncertainty

3. is seen as a threat to important goals

-

Aurora

The Guardian - 16/07/12

The eurozone endgame will begin in Greece

Greece won't be able to make its austerity policies stick and, as the global depression worsens, will have to leave the eurozone.

Article continues ...

- RenewableCandy

- Posts: 12777

- Joined: 12 Sep 2007, 12:13

- Location: York

That's not actually right. A crisis needn't necessarily come as a surprise, for example. "Crisis" literal meaning is "the point at which a decision has to be made". Comes from the same root as "criticise" (as in, to judge) and the like. Ironically, from the olde Greek.energy-village wrote:What is a crisis? Quick google.

What we're going through now should not really be a 'surprise' and I assume the 'important goals' envisaged are further growth. Even in the best scenario how long can that go on given we live on a little planet with a booming population?Seeger, Sellnow and Ulmer:

Includes:

1. unexpected (i.e., a surprise)

2. creates uncertainty

3. is seen as a threat to important goals

- energy-village

- Posts: 1054

- Joined: 22 Apr 2008, 22:44

- Location: Yorkshire, UK

- biffvernon

- Posts: 18538

- Joined: 24 Nov 2005, 11:09

- Location: Lincolnshire

- Contact:

Stephanomics was back this morning on Radio 4. Steph Flanders in discussion with three people with big track records in the subject.

Superficially, it sounded a very intelligent discussion, but when one listens hard one realises that none of them have a clue and the word 'energy' or anything vaguely related to it was not mentioned once.

http://www.bbc.co.uk/programmes/b01ks52r#synopsisIn the first of a new series of her award-winning programme on the economics of our times, the BBC's Economics Editor Stephanie Flanders discusses with leading economists what will pull Britain out of recession and restore the economy to growth. In the 1930s, after the Great Depression, Britain got growth first through a housing boom in the private sector and then through a world war. Eighty years later, what is going to do the trick this time?

Among those joining Stephanie are the leading economic historian, Nicholas Crafts; the expert on housing and planning and former member of the Bank of England's monetary policy committee, Kate Barker; and Oxford economist, Dieter Helm.

Superficially, it sounded a very intelligent discussion, but when one listens hard one realises that none of them have a clue and the word 'energy' or anything vaguely related to it was not mentioned once.

- emordnilap

- Posts: 14815

- Joined: 05 Sep 2007, 16:36

- Location: here

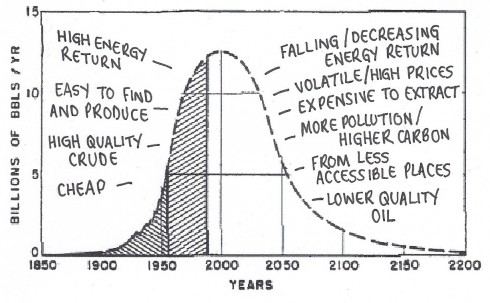

Pity they hadn't prepared by reading and internalising such concepts as shown on the graph here:

(whole article here).

Sure, another energy source will be along soon. All we have to do is use up fossil fuels quickly enough to drive the necessary innovation!

(whole article here).

Sure, another energy source will be along soon. All we have to do is use up fossil fuels quickly enough to drive the necessary innovation!

I experience pleasure and pains, and pursue goals in service of them, so I cannot reasonably deny the right of other sentient agents to do the same - Steven Pinker

- emordnilap

- Posts: 14815

- Joined: 05 Sep 2007, 16:36

- Location: here

- UndercoverElephant

- Posts: 13498

- Joined: 10 Mar 2008, 00:00

- Location: UK

http://blogs.telegraph.co.uk/finance/am ... o-project/

The IMF could hardly be clearer. It is a pre-emptive move to pin responsibility for the coming deluge exactly where it belongs:

On those who created this doomsday machine and pushed it through as a federalist Trojan horse, with scant concern for Europe’s democracies; on a second group of people who ran it for a decade with high-handed arrogance, disregarding warnings as the North-South gap grew to dangerous levels; and on a third group of leaders – led by Chancellor Angela Merkel – who now refuse to face up to the awful implications of what has happened.

The IMF is the leader of the Eurosceptic camp now.

"We fail to mandate economic sanity because our brains are addled by....compassion." (Garrett Hardin)

-

Aurora

BBC News - 23/07/12

Moody's warns on Germany's AAA credit rating

The credit ratings agency Moody's has warned the outlook for Germany's AAA credit rating is negative, the first step towards a possible downgrade.

The ratings for the eurozone's other top-rated economies the Netherlands and Luxembourg were also put on negative outlooks.

Moodys said the countries were at risk from wider eurozone troubles and a possible Greek exit from the euro.

France and Austria lost their AAA ratings earlier this year.

Original Article

-

SleeperService

- Posts: 1104

- Joined: 02 May 2011, 23:35

- Location: Nottingham UK

The sidebar article quoting Wolfgang Schaeuble is quite revealing. He appears to have accepted Greece's collapse out of the Eurozone and switched to Spain will be OK. Interesting as earlier he said similar things about Greece being OK in the long term.

May this be a sign that somebody is preparing a managed descent?

Germany even facing a suggestion of losing it's AAA rating will be a shock to most of the population, I wonder what the 'Wise Men' are talking about this morning??

May this be a sign that somebody is preparing a managed descent?

Germany even facing a suggestion of losing it's AAA rating will be a shock to most of the population, I wonder what the 'Wise Men' are talking about this morning??

Scarcity is the new black

-

Aurora

The Guardian - 24/07/12

How Finland keeps its head above eurozone crisis

Finland's economy is dominated by services but it is competitive in manufacturing – and its revenues are bigger than its debt.

Article continues ...

-

Aurora

When are TPTB going to wise up to the fact that the eurozone is a dead parrot?The Guardian - 25/07/12

Eurozone fears ease on hopes of ECB intervention

Financial markets bounce on indications that the European Central Bank will boost firepower of eurozone bailout fund.

Article continues ...

More good money after bad.

-

Aurora

The Guardian - 26/07/12

Euro is irreversible, declares European Central Bank president Mario Draghi

ECB will do 'whatever it takes' to preserve the currency.

Article continues ...

- UndercoverElephant

- Posts: 13498

- Joined: 10 Mar 2008, 00:00

- Location: UK

What Mario Draghi wants is irrelevant. He can't print until the German constitutional court tells him he can.Aurora wrote:The Guardian - 26/07/12

Euro is irreversible, declares European Central Bank president Mario Draghi

ECB will do 'whatever it takes' to preserve the currency.

Article continues ...

"We fail to mandate economic sanity because our brains are addled by....compassion." (Garrett Hardin)