Ok V, sorry about the delay.vtsnowedin wrote:Looking forward to it.stevecook172001 wrote:That is factually wrong. Right now I don't have the time. But, I will be back in later today and will spell out why it is wrong. The "money" in your bank account is not money. It is at least 90% debt that has lent into existence by your bank and/or by other banks up the food chain. 10% or less of the money in that account has originated from the central bank. The rest has been conjured out of fresh air. I'm not kidding. If you don't believe me, what the bloody hell do you think all the bailouts were about? The only thing that stops the entire fraudulent ponzi-scheme from collapsing is economic growth. When that stops, the fraud is exposed. When that happens, the funny money has to be replaced with "real" money" or a real promise to replace it by a sovereign state at some point in the future. (ie, the taxpayer)vtsnowedin wrote: Yes the balance in your check book is money even though the bank doesn't have a stack of bills in the vault equal to all the deposits on the books....

The whole process makes a complete mockery of the so-called "fractional reserve ratios".

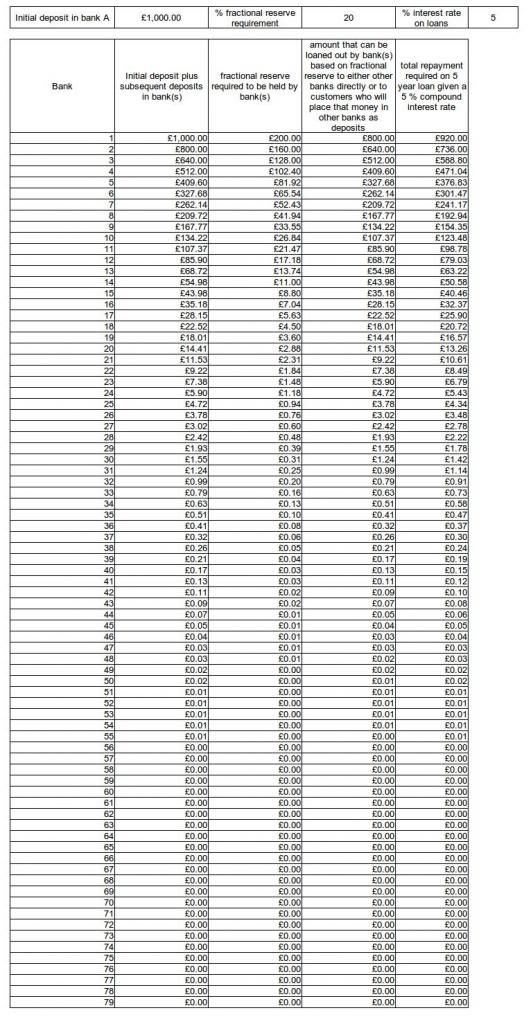

As I am sure you are aware, the banks must operate on a fractional reserve ratio. That is to say, they can only lend out a fraction of the deposits they hold. However, this only make sense of the deposits they hold are, themselves, real money. The problem is they are not. I need to include a few tables to show how this works.

The above is an example table showing how an initial £1000 created by a Central bank and then placed in Bank A, cascades down through the banking system being lent out over and over again. This is because the lendings of one bank are allowed to be used as the deposits of other banks. I have emboldened this last sentence because it is the key. Just think about it for a minute and you will realize why.

Of course, each time the money enters the next bank in the chain, a bit is shaved off the amount that can subsequently be lent out because some of the debt-based deposit must remain on the deposit side of a given bank's books. The process of re-lending out of the same money only stops when infinity is approached.

So, starting from a baseline figure of 1000 central bank money, we end up with a situation where the total amount of "money" in the system is £4000 (due to banks effectively using the debt side of other banks' balance sheet as the deposit side on their own balance sheet) and that the debt based monetary system must actually grow over the next 5 years by another £600 just to make the books balance at the end of that period. This is because of the compound interest applied to the loans.

The only way the above can be made to work is if the central bank continues to lend money into the system to cover the hole in the balance sheet implied by interest rates on loans. But, of course, the banks are simply going to multiply lend out any new money that comes into the system and so the problem keeps on growing.

All of the above is the reason why governments shit themselves when growth stops because, when that happens, the ponzi-scheme money-supply promptly collapses. However, they can't allow it to collapse and so they keep pushing money into the system regardless. The trouble is, this new money no longer has an economic home to go to (due to halted growth) and so merely has the effect of causing inflationary driven prices rises due to the oversupply of money. This is why recessions often bring inflationary price rises with them instead of deflationary collapses in prices, which is what one might have intuitively expected.

In the above example, the central bank base money supply will need to grow to £1150 in 5 year's time to cover the interest repayments on the loans and this means that there is a built-in requirement that the economy will grow by 3% per year for each of those 5 years to accommodate the extra money flowing into the system. Any growth less than that and you end up either with deflation (if the CB does not create enough base money) or inflation (if the CB does create the money). The only way you avoid either inflation or deflation is if the economy grows by just the right amount. Whatever happens, the economy must perpetually grow in order for this type of FRB-based money-supply to work.

In short, an FRB-based money-supply is always a car-crash waiting to happen and on a finite planet of finite resource you can be guaranteed it will happen (due to the limits to growth implied by those finite resources).

It's happening right now.