Not if you're desperate and don't have any choice.Quintus wrote:Shouldn't assets be sold off when they're on a high?

Government to sell off £16 billion of assets

Moderator: Peak Moderation

-

kenneal - lagger

- Site Admin

- Posts: 14287

- Joined: 20 Sep 2006, 02:35

- Location: Newbury, Berkshire

- Contact:

All the more reason to avoid nationalising anything. The nationalised industries were always rubbish and there's no reason to think that they would be any better again now.JohnB wrote:Would you really trust a bunch of [insert your favourite expletive here] who can't even sort out their own expenses, to get a good deal when selling the family silver

Even Cuba is privatising their farms as the collective farms have just given up on huge areas of land, leaving it derelict. Something like 75% of food is grown on 25% of the land that is privately run.

Action is the antidote to despair - Joan Baez

I got the dates wrong, the IMF loan to Britain was in late-1976, under the then Labour government, but the results of it's conditions lasted into the 1980's. Labour government did it's level best to avoid the pressure placed upon it, but it was Thatcher's Conservative government that implemented them.Ludwig wrote:I didn't know about this. I assumed privatisation was just a fundamental part of Tory ideology. Any references? I'd be interested to learn more.syberberg wrote:They didn't really have a choice though, what with having to ask for an IMF loan. Would've been nice if they'd actually told the truth about exactly why they had to rather than the BS of "modernising Britain", but that's politicians for you.biffvernon wrote:Yes. The Tories sold off the family silver last time they were in power.

Further reading.

And here's the Freedom of Information Request to disclose documents pertaining to the 1976/77 IMF loan: Very intersting reading.

Hope that helps.

- emordnilap

- Posts: 14823

- Joined: 05 Sep 2007, 16:36

- Location: here

http://anglobuddhistcombine.blogspot.co ... -that.html

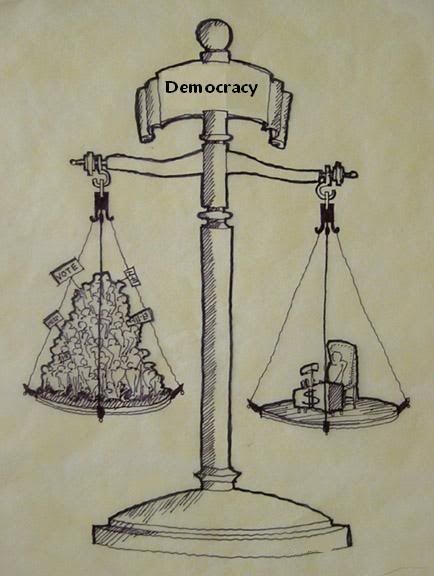

Ah good, someone gets it....and another example of the way in which the UK's response to the financial crisis seems to be more and more mirroring Naomi Klein's "Shock Doctrine" analysis - the idea that global capitalism now takes advantage of crises - whether financial, social or natural - to privatise everything in sight.

I experience pleasure and pains, and pursue goals in service of them, so I cannot reasonably deny the right of other sentient agents to do the same - Steven Pinker

Previously I'd heard that this might happen - some of the jobs to go abroad.

Civil Service Facing Privatisation Threat

The Government is considering establishing public service companies to privatise IT and human resources for its Whitehall departments, according to Sky Sources. The companies could outsource "back office" functions for the civil service and would potentially raise billions in public revenue, sources added.

It is thought an estimated 30,000 jobs would be shifted into these specially created corporate entities.

Those pushing the idea say there would be benefits all round - the Government would save money as the new companies would deliver a cheaper service. They could then be floated on the stock market, with campaigns that could deliver windfall income to the Government.

Sky's City editor Mark Kleinman said: "These companies would essentially take over traditional Whitehall back office functions like human resources, IT and potentially part of the Government's vast property portfolio."

http://news.sky.com/skynews/Home/Busine ... 4515?f=rss

-

2 As and a B

- Posts: 2590

- Joined: 28 Nov 2008, 19:06

Better add playing fields, libraries, council estates and cemeteries to the "possibles" list (see article).

4m council houses at, say, £50k each = £200bn.Mr Brown said the Tote bookmaker, Dartford crossing, Channel Tunnel rail link and the Student Loan Book would be sold to raise £3billion

... The PM insisted the rest of the £16billion had to come from Local Government. He said council estates could be among those assets sold to and managed by the private sector.

... Playing fields, libraries and entire council estates would be sold off in Gordon Brown's "fire sale" of Government assets, town hall bosses warned last night.

13/10/2009

http://www.mirror.co.uk/news/top-storie ... -21743185/

-

kenneal - lagger

- Site Admin

- Posts: 14287

- Joined: 20 Sep 2006, 02:35

- Location: Newbury, Berkshire

- Contact:

So let me get this right.

The UK Govt bails out the banks by giving them many £billions in cash of our money, for priority shares of one type or another ie bits of paper......

And in turn the UK Govt has to sell off "real land, buildings, houses, assets", the ones our taxes have accumulated over the decades.

Is that it?

The UK Govt bails out the banks by giving them many £billions in cash of our money, for priority shares of one type or another ie bits of paper......

And in turn the UK Govt has to sell off "real land, buildings, houses, assets", the ones our taxes have accumulated over the decades.

Is that it?

Real money is gold and silver

- emordnilap

- Posts: 14823

- Joined: 05 Sep 2007, 16:36

- Location: here

- RenewableCandy

- Posts: 12780

- Joined: 12 Sep 2007, 12:13

- Location: York

Raise £3 billion in the fire sale - and then give £5bn more (albeit for shares) to Lloyds.

Mr Brown said the Tote bookmaker, Dartford crossing, Channel Tunnel rail link and the Student Loan Book would be sold to raise £3 billion

13/10/2009

http://www.mirror.co.uk/news/top-storie ... -21743185/

Lloyds asks taxpayers for another £5bn

Alistair Darling is ready to hand over up to £5bn of taxpayers' money to the part-nationalised Lloyds Banking Group in order to shore up its finances ...

14/10/2009

http://www.guardian.co.uk/business/2009 ... rling-cash

Nothing like that. Some councils have "stock transferred" estates to Housing Associations for nominal sums on the basis that the HAs will borrow gov't money to refurbish the properties. No savings apparent.kenneal wrote:I thought council estates had been "sold off" to Housing Associations.

Other councils have chosen to use "Private Finance Initiative" money to refurbish properties and manage them but the managers tend to be the same people as run Housing Assocs now.

The third scheme is the Arms Length Management Organisation which means using a limited company structure to manage the stock at a distance from the council.

PFI and ALMO still means the council owns the housing. Maybe you think more tenants can be encouraged to buy their residences by borrowing more than they can afford? That's what got us into the present financial crisis. Sales to sitting tenants have reduced lately which is assumed to be because the market is saturated for council tenants after 20 odd years of sales.

Any more ideas? Putting the rents up simply means a proportion of tenants pay more and the rest claim more housing benefit. Council housing isn't going to solve the gov-t's financial problem.